Amazon Product Research: A Risk-First, Step-by-Step Guide for Sellers

Amazon product research is not just “finding a product.” It is a risk-management workflow that protects your cash, your account, and your time. This guide gives you a risk-first Amazon product research system, plus a checklist and scoring template you can use immediately.

Without a risk-first process, a single bad product choice can trap months of capital in slow-moving inventory and make recovery painfully slow. [To be verified]

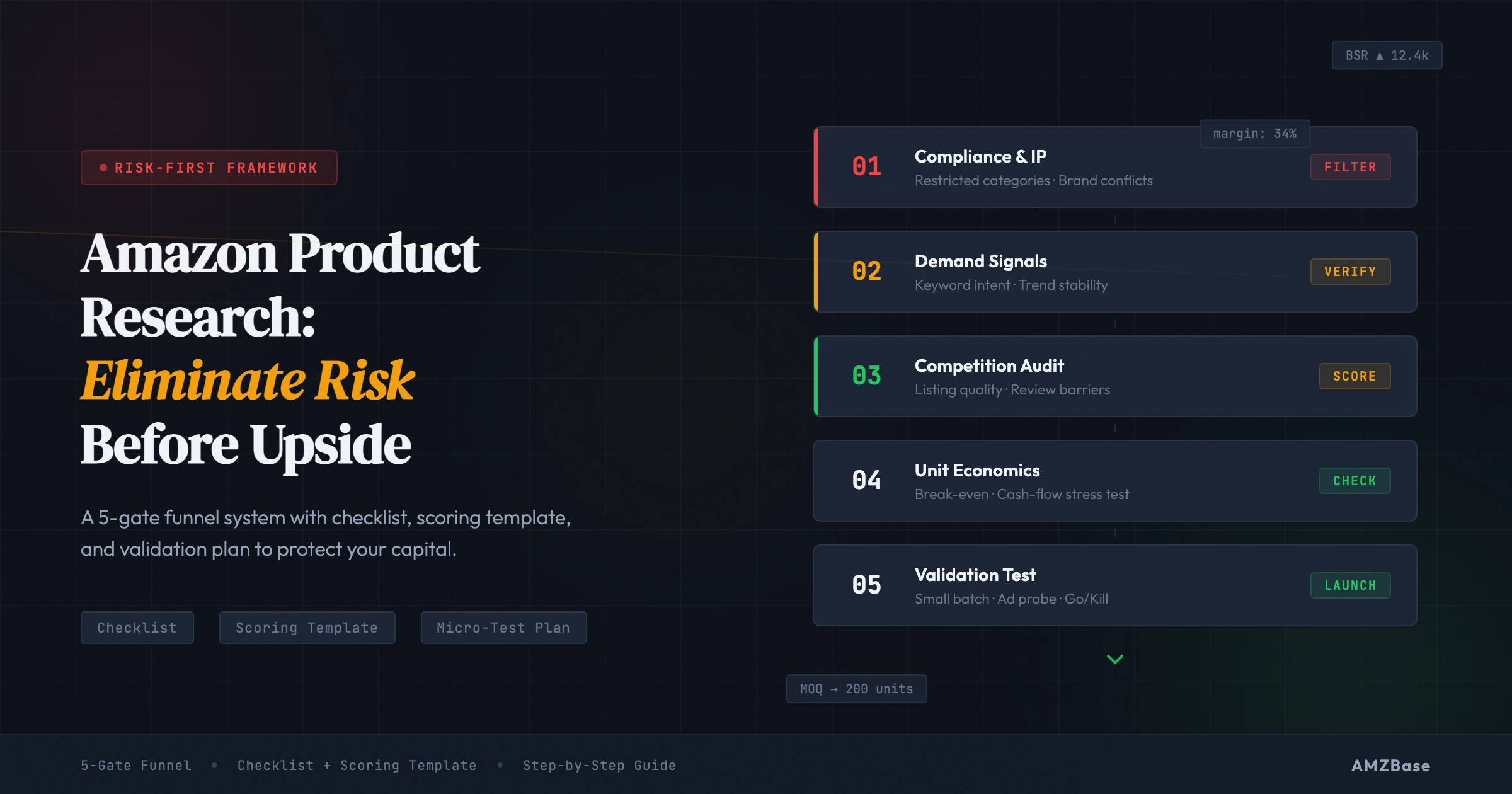

The Risk-First Product Research Framework

Amazon product research is a structured process to screen ideas for compliance risk, demand, competition, and unit economics before you invest in inventory. A risk-first approach removes non-viable ideas early, then validates remaining products with small tests to reduce costly mistakes.

The core idea is simple: eliminate risk before you chase upside. Most guides start with demand, but real sellers get hurt by compliance issues, supplier constraints, and margin surprises. [To be verified] This framework flips the order so you only invest time in products that are actually buildable.

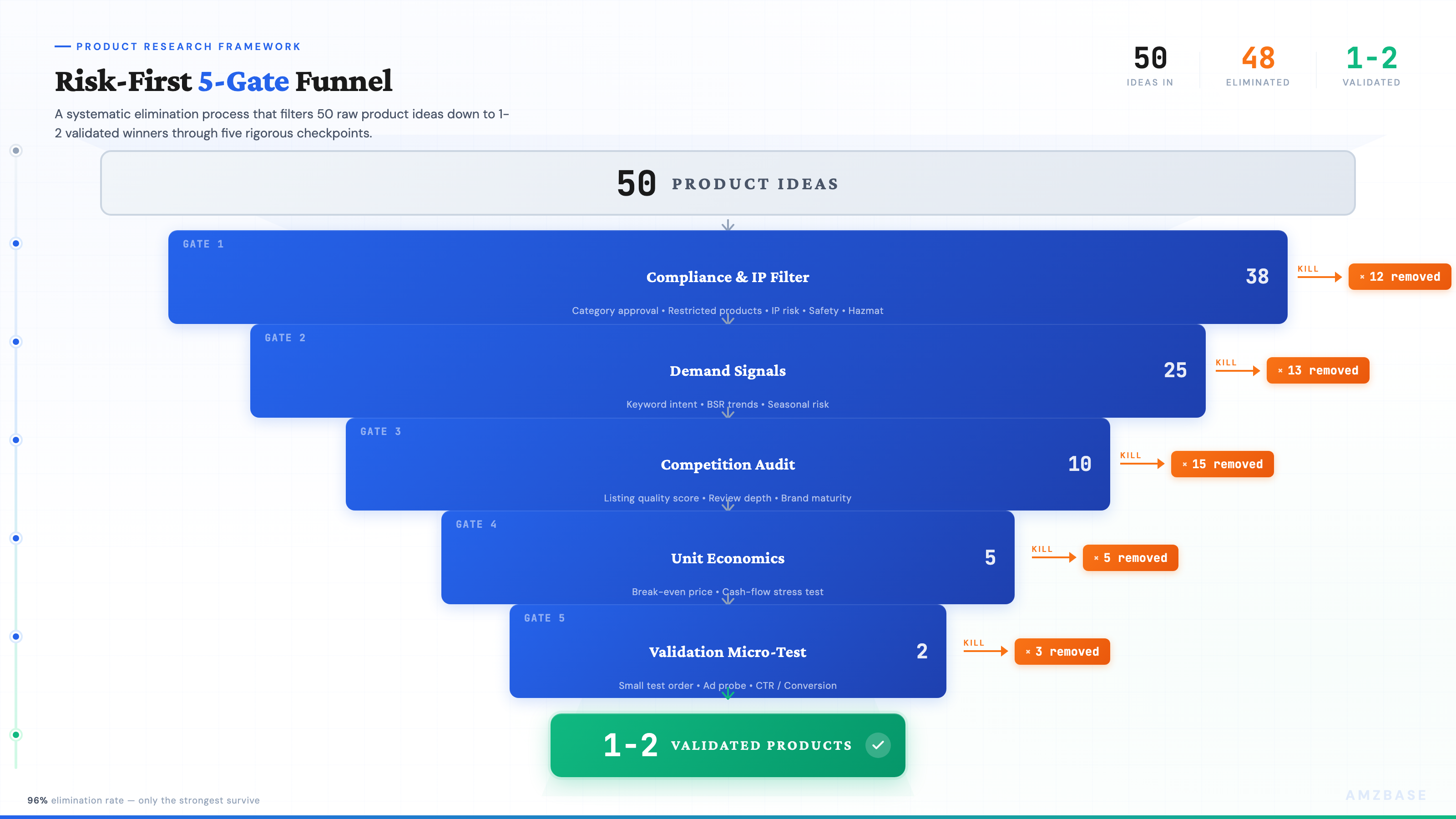

The 5-gate funnel (deliverable):

- Compliance & IP filters

- Demand signals

- Competition audit

- Unit economics + cash-flow check

- Validation micro-test

Running example (hypothetical, Lina): Lina is a US-based private-label seller with an $8k launch budget. She starts with 50 kitchen-organization ideas, but the 5-gate funnel quickly cuts them down to 20 viable candidates before she wastes time on data tools.

You might be thinking: “This sounds slow.” Here’s the workaround: the first two gates can be done in 60-90 minutes per product if you use the checklist and scoring template provided later. [To be verified]

A product that can’t survive a risk filter isn’t an opportunity – it’s a liability.

Next, let’s handle the biggest account-level risk: compliance and IP.

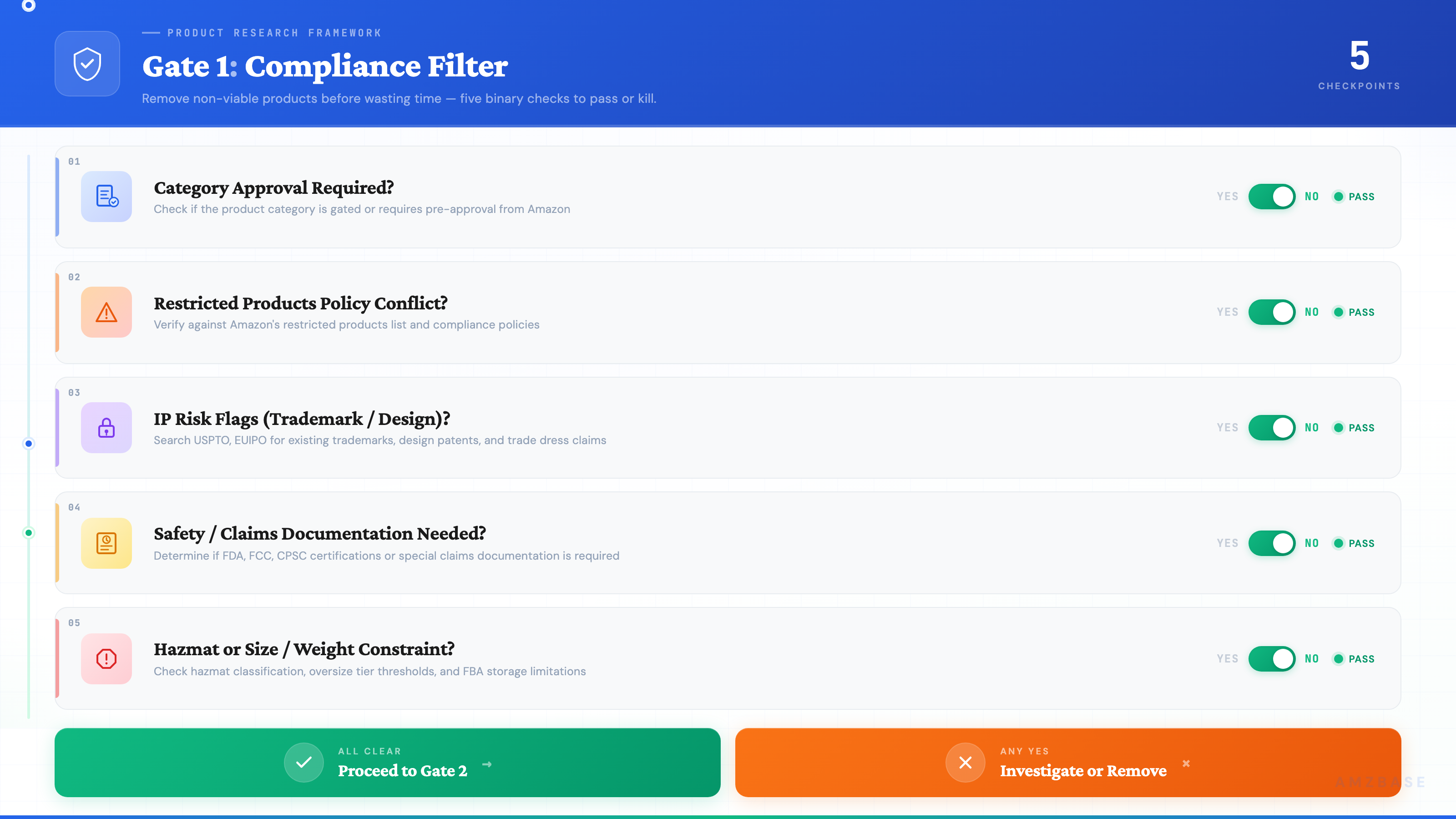

Gate 1 – Compliance, IP, and Restricted Product Filters

- Check restricted categories and category approval needs.

- Screen for IP and brand conflicts.

- Verify safety, labeling, and claim requirements.

- Confirm size/weight or hazmat restrictions.

- Document evidence in a product log.

Actionable deliverable: Compliance filter checklist

- Category approval required? (Yes/No)

- Restricted products policy conflict? (Yes/No)

- IP risk flags (trademark or design risk)? (Yes/No)

- Safety/claims documentation needed? (Yes/No)

- Hazmat or size/weight constraint? (Yes/No)

As of March 2025, Amazon’s restricted products and category approval rules can change, so you should verify in Seller Central before any order. [Source: Amazon Seller Central Help]

For IP screening, look for active brand enforcement and design patents in your niche. If a brand is enrolled in Amazon Brand Registry, assume IP infringement risk is higher unless you have authorization. [Source: Amazon Seller Central Help]

Running example (hypothetical, Lina): Lina removes 12 ideas after seeing category approval requirements and brand-heavy listings in those niches. That saves weeks of back-and-forth and potential listing takedowns.

Soft CTA (30% mark): If you also need a listing optimization plan after product selection, review this internal guide: Amazon listing optimization checklist .

Now that we have a clean, compliant list, we can evaluate real demand without bias.

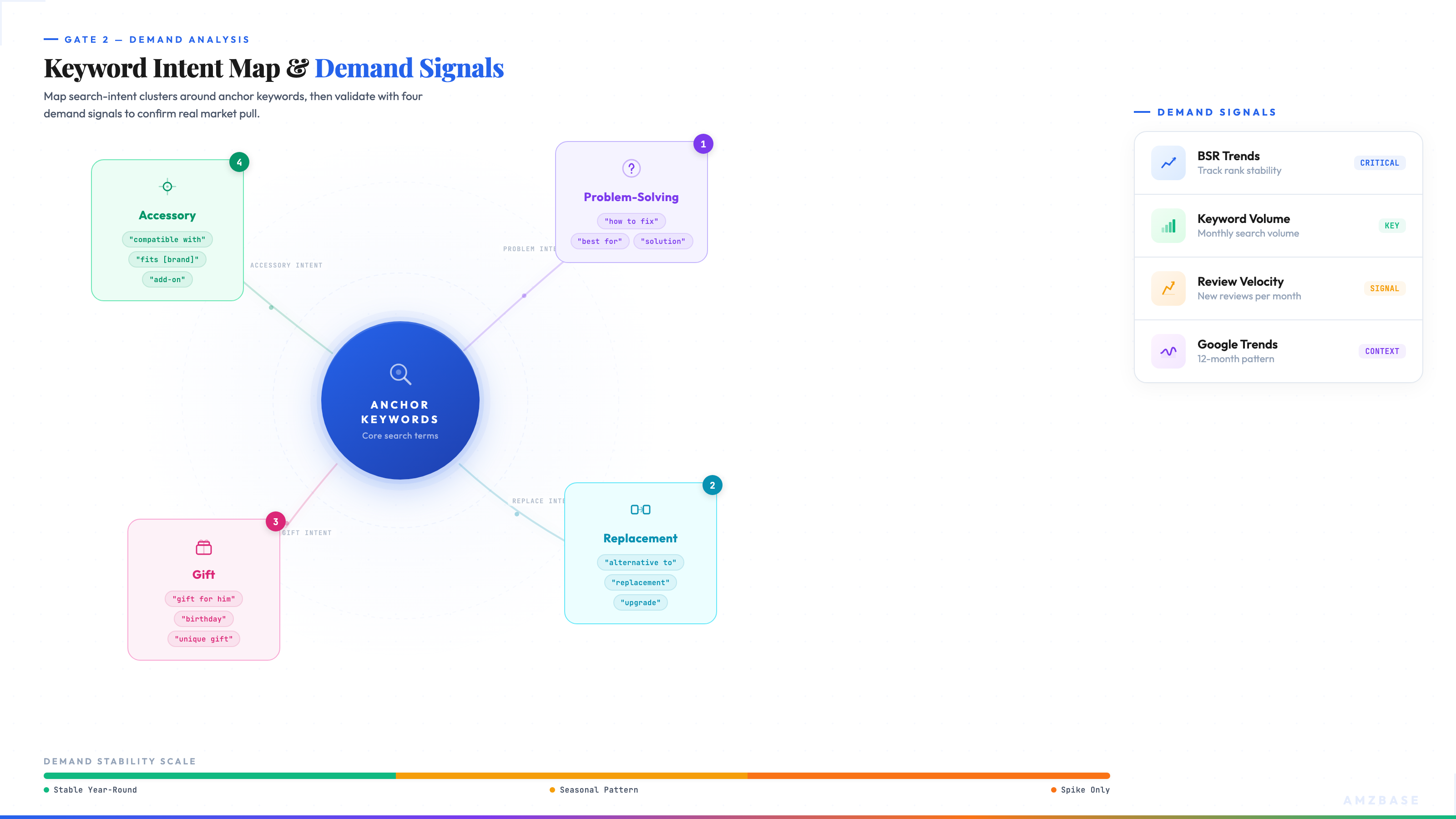

Gate 2 – Demand Signals and Keyword Intent Mapping

As of this step, you are looking for stable demand signals and clear buyer intent, not just big numbers. Demand signals can include keyword volume, Best Sellers Rank (BSR) trends, and consistent review velocity, but each has limits and must be cross-checked. [To be verified] Treat this as Amazon niche research: stability beats spikes.

Actionable deliverable: Keyword intent map (steps)

- List 5-10 core keywords per product idea.

- Cluster by intent: “problem-solving,” “replacement,” “gift,” “accessory.”

- Identify 1-2 “anchor” keywords per cluster.

- Validate trend stability with Google Trends or historical data tools.

- Flag seasonal spikes and mark them as high risk.

Tools sellers commonly use include Jungle Scout, Helium 10, Keepa, and Google Trends. These product research tools for Amazon sellers help speed analysis, but they don’t validate your idea; your goal is to build a stable intent map that can be tested with ads later. [To be verified]

Since the 2024 holiday season, many home-organization keywords show pronounced Q4 spikes, so treat year-end data as a risk signal rather than a green light. [To be verified]

Running example (hypothetical, Lina): Lina discovers that “drawer organizer for forks” spikes every November, while “expandable drawer organizer” stays steady year-round. She moves the seasonal term to a lower-priority list.

But what if you don’t have paid tools? Use Amazon autocomplete, category best-seller pages, and Google Trends as free proxies. This isn’t perfect, but it’s enough to decide whether to invest in deeper validation.

Next, we turn these demand signals into a clear view of competition quality.

Gate 3 – Competition and Listing Quality Audit

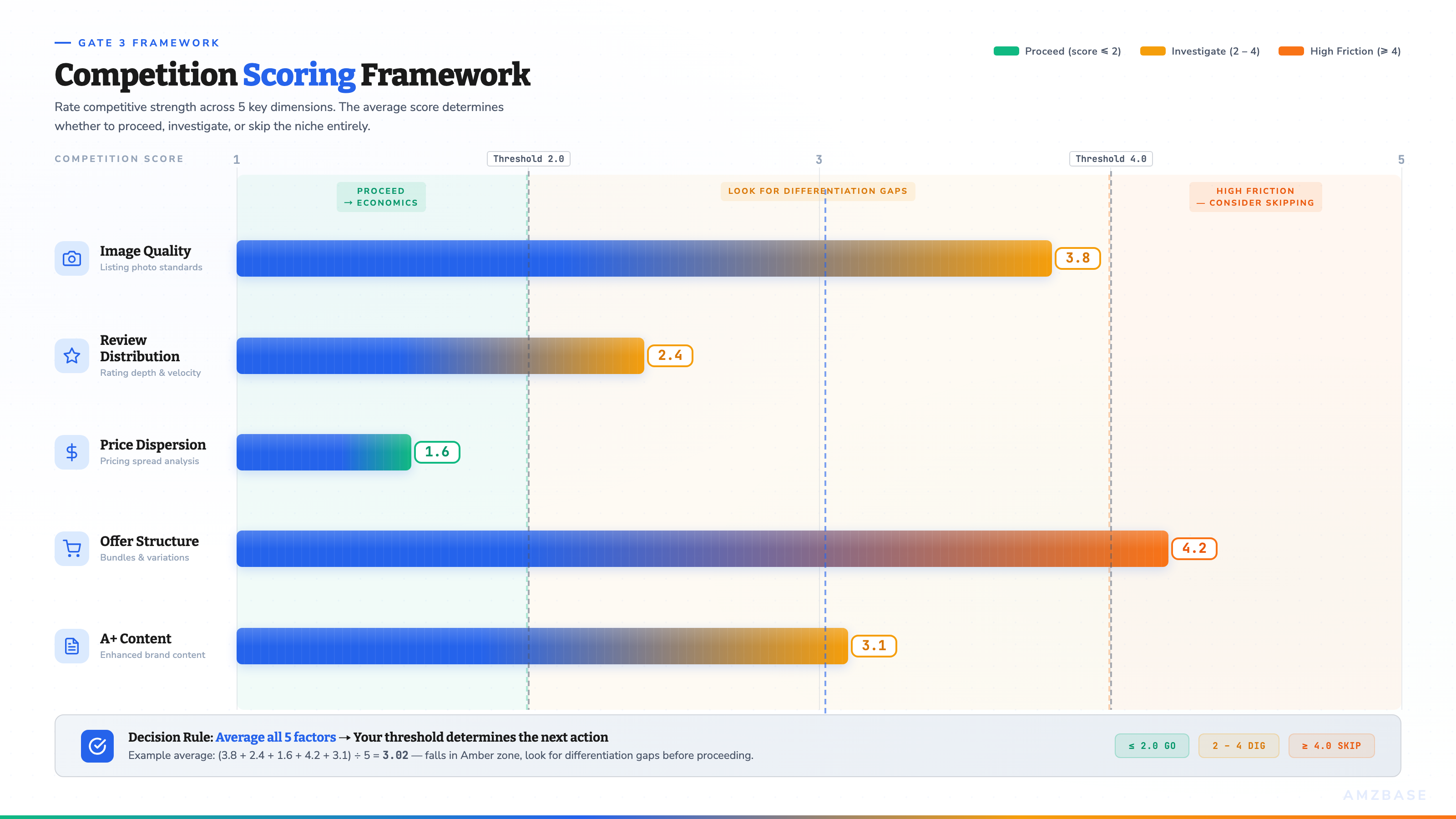

| Factor | What to check | Why it matters | Score (1-5) |

|---|---|---|---|

| Image quality | Lifestyle + infographics | High-quality listings are harder to beat | |

| Review distribution | Top 5 listings review counts | Shows barrier to entry | |

| Price dispersion | Spread between low/high | Signals room for differentiation | |

| Offer structure | FBA/FBM mix + Buy Box rotation | Impacts conversion and ad cost | |

| A+ content | Presence/quality | Indicates brand maturity |

Actionable deliverable: Competition scoring instructions

- Score each factor 1-5, then average.

- If average >=4, treat as “high friction.”

- If average 2-3, look for differentiation gaps.

- If average <=2, proceed to economics check.

Buy Box dynamics can dramatically change your unit economics and ad efficiency. [To be verified] If top listings are dominated by entrenched brands or bundles, competition may be higher than review counts suggest. [To be verified]

Running example (hypothetical, Lina): Her top 8 candidates are now down to 5 after two niches show extremely polished listings and dominant bundle offers.

You might be thinking: “I can beat better listings with ads.” But if the listing quality gap is large, ads can magnify losses rather than fix them. [To be verified] That’s why we test economics next.

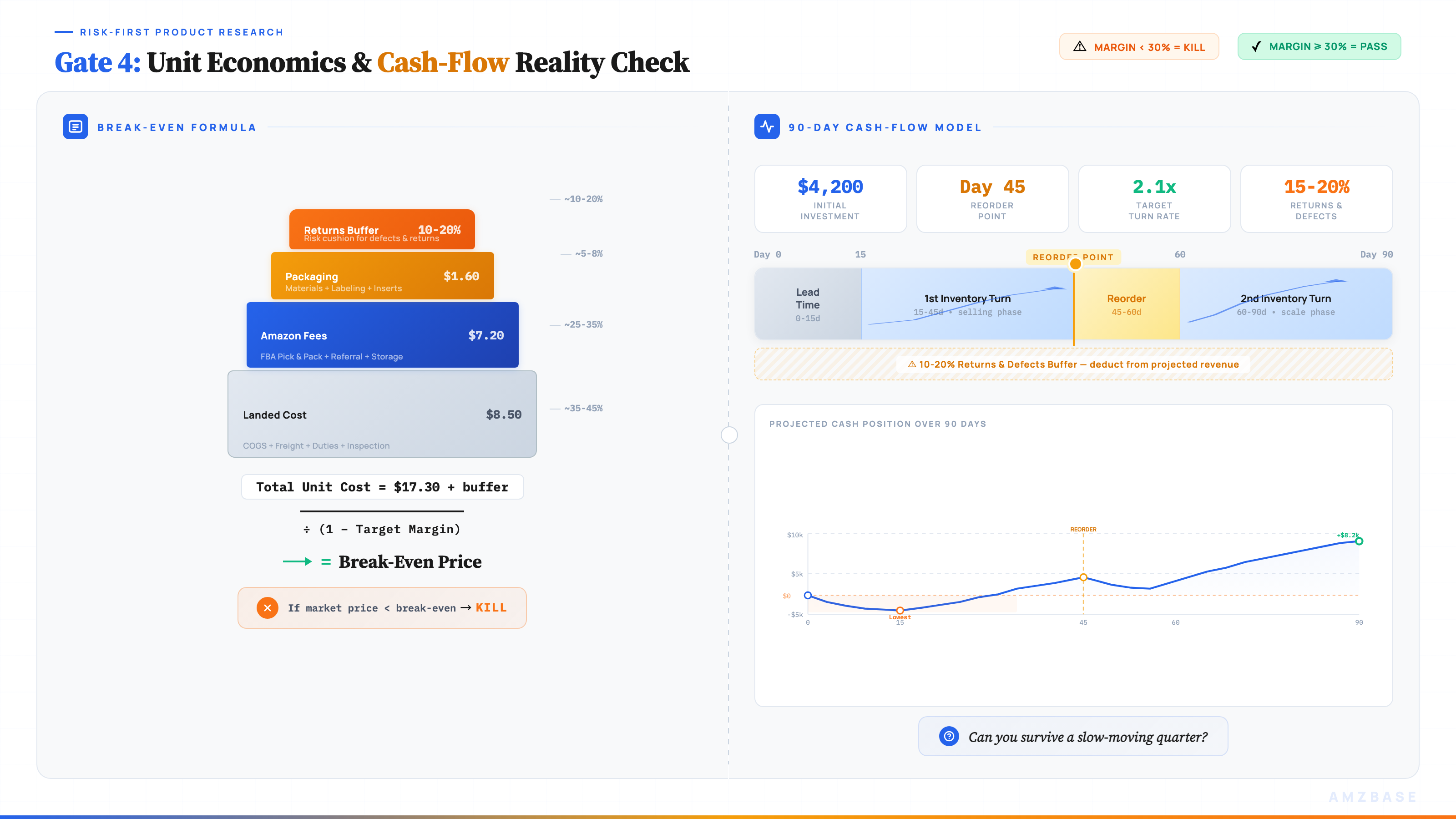

Gate 4 – Unit Economics and Cash-Flow Reality Check

The key takeaway: if unit economics fail on a single conservative scenario, the product is not ready.

Actionable deliverable: Break-even calculation (template)

Break-even price = (Landed cost + Amazon fees + Packaging + Returns buffer) / (1 - Target margin)

As of February 2025, you should verify the latest FBA fee schedule inside Seller Central because size/weight tiers and surcharges can change. [Source: Amazon Seller Central Help]

FBA vs FBM quick comparison (deliverable):

- FBA: higher fees, stronger Prime conversion, lower ops overhead. [To be verified]

- FBM: lower fees, more control, higher service workload. [To be verified]

Cash-flow stress test (steps):

- Estimate lead time and reorder point.

- Model 2 turns of inventory in 90 days. [To be verified]

- Add a 10-20% buffer for returns and defects. [To be verified]

- Confirm you can survive a slow-moving quarter.

Running example (hypothetical, Lina): Two products pass demand and competition but fail cash-flow stress tests because of long lead times and heavy packaging costs. She drops them.

If the numbers look tight, reduce risk by lowering MOQ or adjusting bundle size – and then validate before scaling. In the next section, you’ll build that validation plan.

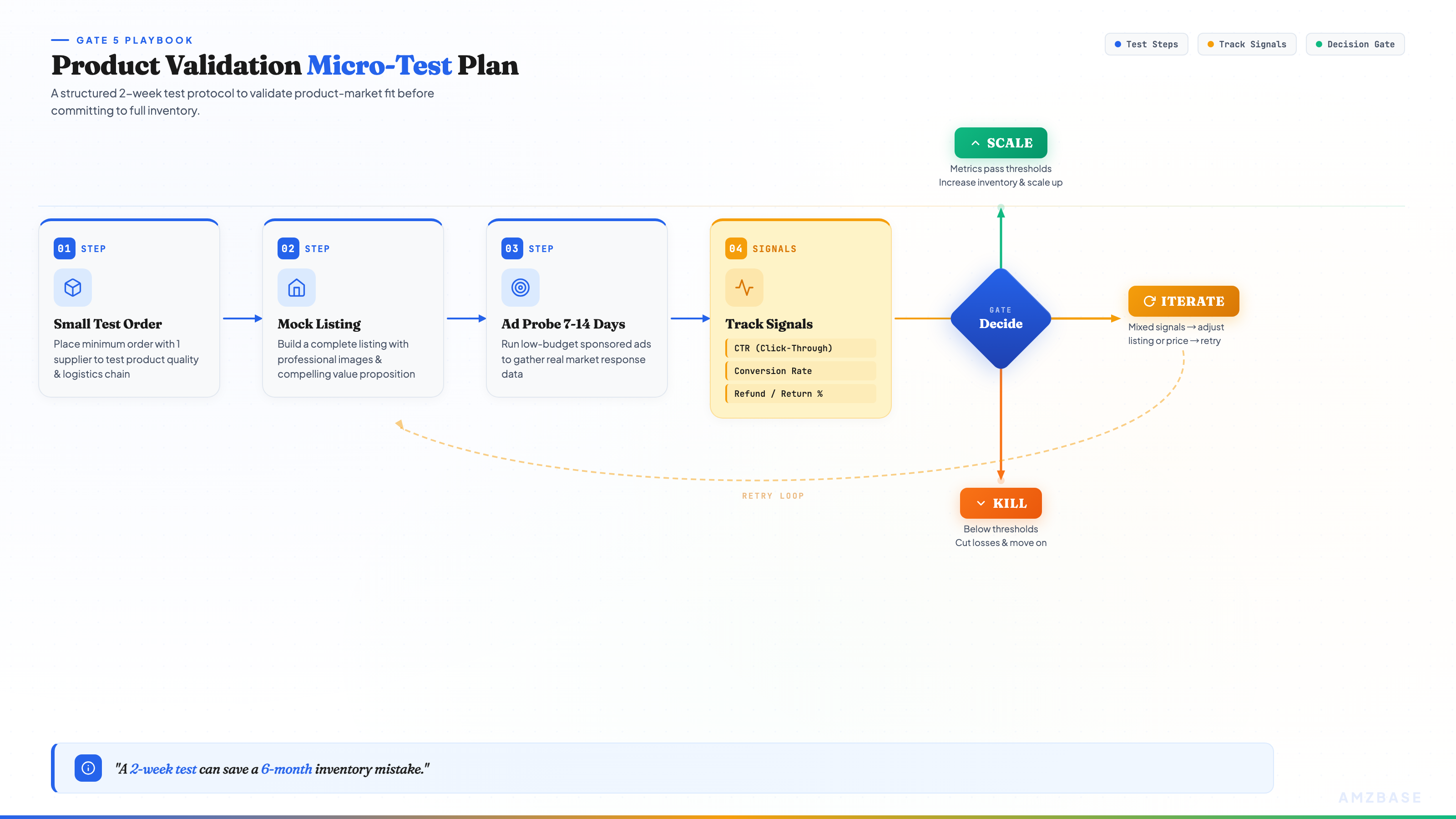

Gate 5 – Product Validation Plan (Micro-Test)

This is where hypotheses meet reality. A validation plan is not a full launch; it is a minimal test that protects your cash and confirms demand signals. In private label product research, this step is often the difference between a small lesson and a big loss. [To be verified]

Actionable deliverable: Amazon product validation micro-test plan (steps)

- Place a small test order with one supplier.

- Build a “mock listing” with images and a clear value proposition.

- Run a low-budget ad probe for 7-14 days. [To be verified]

- Track CTR, conversion, and refund signals.

- Decide: scale, iterate, or kill.

Running example (hypothetical, Lina): She tests three products with small batches, but only one meets her conversion threshold. The other two show weak click-through and ambiguous reviews.

Social proof anchor (hypothetical): Consider a hypothetical cohort of mid-sized private-label sellers who only scale after a two-week ad probe and supplier QA. Their failure rate drops sharply compared to “full-order-first” launches. [To be verified]

If you’re worried about time, remember: a two-week test can save you a six-month inventory mistake. [To be verified] Next, we’ll cover the mistakes that cause those six-month setbacks.

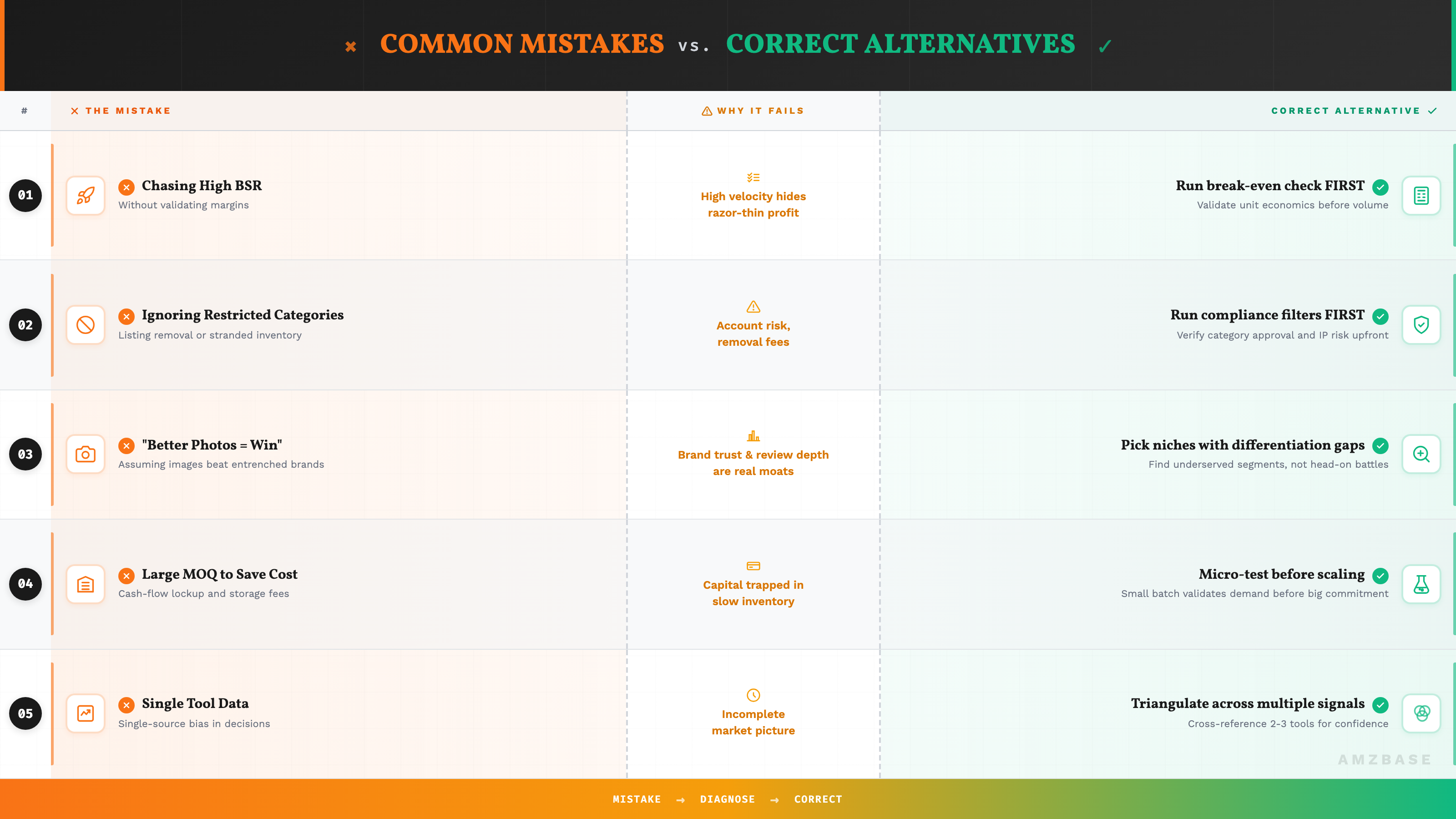

Common Mistakes in Amazon Product Selection (and What to Do Instead)

Here are the most damaging mistakes and the fixes that stop them from repeating.

Inventory is a cash decision before it is a marketing decision.

Actionable deliverable: Mistake -> Why it fails -> Correct alternative

- Mistake: Chasing high BSR without validating margins -> Why it fails: high velocity can hide razor-thin profit -> Correct alternative: run a break-even check before any demand deep-dive.

- Mistake: Ignoring restricted or approval-only categories -> Why it fails: listing removal or stranded inventory -> Correct alternative: run compliance filters first.

- Mistake: Assuming “better photos” beats entrenched brands -> Why it fails: brand trust and review depth are real moats -> Correct alternative: pick niches with visible differentiation gaps.

- Mistake: Ordering large MOQ to “save on cost” -> Why it fails: cash-flow lockup and storage fees -> Correct alternative: micro-test before scale.

- Mistake: Using only one tool’s data -> Why it fails: single-source bias -> Correct alternative: triangulate demand across multiple signals.

Loss frame: If you skip these checks, you can lose the Buy Box, incur removal fees, or get stuck with unsellable inventory that ties up your working capital for months. [To be verified]

Group behavior data point: A meaningful share of top-performing sellers run a validation test before placing a large MOQ. [To be verified]

If you’ve already made one of these mistakes, don’t panic – the next section gives you a checklist and scoring template to rebuild your process quickly.

The Checklist + Scoring Template (Copy and Use Today)

This section contains the two core assets you can reuse every time you evaluate a product.

Asset 1: Amazon Product Research Checklist (deliverable)

- Compliance: restricted category, approvals, IP checks complete

- Demand: 2-3 stable keyword clusters identified

- Competition: listing quality score <=3 or clear differentiation

- Economics: break-even price fits target margin

- Validation: micro-test plan defined

Asset 2: Scoring Template (deliverable)

| Criteria | Score (1-5) | Notes |

|---|---|---|

| Compliance risk | ||

| Demand strength | ||

| Competition intensity | ||

| Unit economics | ||

| Execution complexity | ||

| Overall recommendation |

How to customize the template

- Low budget (<$5k): prioritize compliance and unit economics.

- Mid budget ($5k-$20k): balance demand and differentiation.

- Higher budget: add brand-building and review velocity targets.

Medium CTA (60% mark): Download or copy the checklist and template into your product log today and score your next 10 ideas in one session.

For internal link suggestions, consider these next reads:

Next, we’ll answer the most common questions sellers ask when they apply this framework.

FAQ – Amazon Product Research for Sellers

Actionable deliverable: FAQ quick decision rules

- If compliance is unclear, stop and verify before any demand analysis.

- If unit economics fail in a conservative scenario, kill the idea.

- If validation data is ambiguous, iterate once, then move on.

How to find products to sell on Amazon without paid tools? Start with Amazon autocomplete, category best-seller pages, and Google Trends for trend stability. Then validate demand with a small ad test once you have a short list.

What is a good niche size for a new seller? A “good” niche is one where you can differentiate and profit at your budget level; exact size benchmarks vary by category and should be verified with current data. [To be verified]

How long should product validation take? A lightweight test can take 2-6 weeks depending on supplier lead times and ad learning. [To be verified]

Amazon FBA product research vs FBM: which is better? FBA typically improves conversion but increases fee exposure; FBM offers more control but higher operational overhead. Choose based on margin resilience and service capability.

What is the fastest way to avoid restricted products? Use Seller Central’s restricted products and category approval pages as your first gate before you invest any time in keyword or competition analysis. [Source: Amazon Seller Central Help]

If those answers still leave you unsure, the conclusion below tells you the single next step to take right now.

Conclusion: Turn Product Research Into a Repeatable System

Amazon product research is less about “finding a winner” and more about building a system that protects your capital and learns quickly. If you apply the risk-first gates, use the checklist, and validate before scaling, your odds of long-term profitability improve – even in competitive categories.

Hard CTA: If you want a customized product research workflow and scoring template tailored to your category and budget, start a project brief today and let’s build it together – it’s the fastest way to turn this framework into action.